We all know it costs a lot to raise a kid; we know exactly how much? It’s about $233,610 from birth to 18 years old in the US. The USDA is the source of this data:

Based on the most recent data from the Consumer Expenditures Survey, in 2015, a family will spend approximately $12,980 annually per child in a middle-income ($59,200-$107,400), two-child, married-couple family. Middle-income, married-couple parents of a child born in 2015 may expect to spend $233,610 ($284,570 if projected inflation costs are factored in*) for food, shelter, and other necessities to raise a child through age 17. This does not include the cost of a college education.

There is a vast sea of financial options: 529 savings plan, municipal bonds, savings accounts, the stock market – the list goes on and on. Ultimately the issue we encounter is how do we get the finances to help our kids.

The median income for a household in the united states is roughly $62,000 a year. That means you will have about $48,000 a year after taxes to provide for your family. With only $48,000 a year it’s hard to even look into the impact of a 529 plan or any of the other savings options. Looking at data from Bank of America on average we may spend $47,000 a year “staying alive” (1400 rent/mortgage + 700 Car + 500 Health + 800 Child Care + 500 Food/Fun) * 12 months. That leaves about $1,000 for us to save for our kids. The biggest surprise – that roughly $280,000 to get to 18 (assuming inflation) – does not include education or health expenses after turning 18 😮

There is hope! It’s Gifting Better.

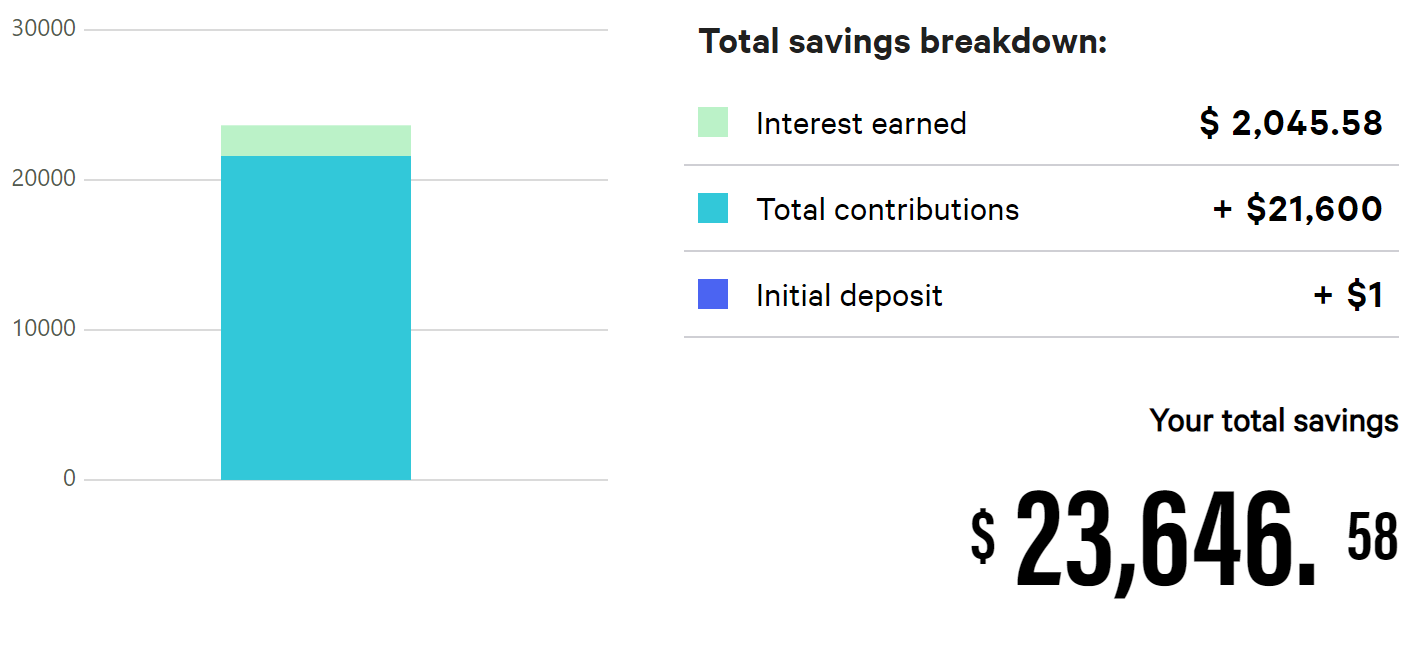

Overtime, we can help you grow the nest egg needed for your kids. Using tools from BankRate you can see how a savings account will help your kids. Gifting Better provides an easy way for your family and friends to gift your kids. They can set up recurring or one-time gifts. Assuming your account is gifted $100 of month with a starting $1 balance you’ll end 18 years with about $23,600 assuming a 1.0% APY. That’s an additional $23,600 to help with your kid’s expenses. Most of all it’s piece of mind knowing you’ve done your best to provide for your kids.